- In addition to the disclosures required in ITR-2, taxpayers must also provide information on interests held in assets of a firm, Association of Persons (AOP), as a partner or member.

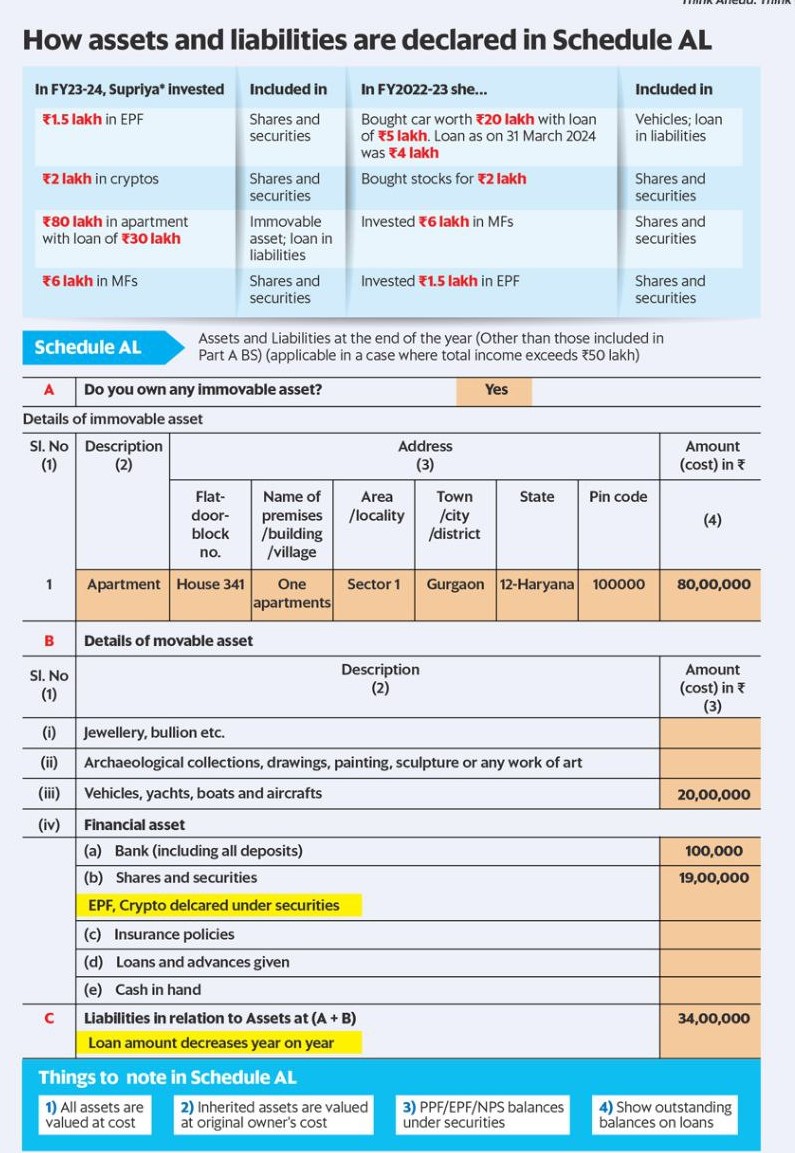

- Movable Assets: Bank deposits, shares and securities, insurance policies, loans and advances given, cash in hand, jewellery, bullion, vehicles, yachts, boats, aircraft, etc.

- Immovable Assets: Land and buildings.

- Liabilities: Corresponding liabilities against the disclosed assets.

Definition and Disclosure of Assets

- Types of Assets: The term ‘assets’ includes:

- Immovable Assets: Land and buildings.

- Financial Assets: Shares, securities, and deposits.

- Loans and Advances: Any loans and advances given.

- Insurance Policies: Details of all insurance policies.

- Cash in Hand: Amount of cash held.

- Jewellery: Ornaments made of gold, silver, platinum, or any other precious metal, or their alloys, whether or not containing precious or semi-precious stones.

- Vehicles: All vehicles owned.

- Movable Assets: Yachts, aircraft, boats, etc.

- Bullion: Precious metals in bulk form.

- Disclosure at Cost: Assets must be disclosed at their cost price. This includes any cost of improvement incurred on the asset.

- Non-Residents and Not Ordinarily Residents: These individuals must provide details of their assets situated in India. ensure that all the specified details are accurately reported. The purpose of these disclosures is to maintain transparency and compliance with tax regulations, ensuring that the taxpayer’s asset holdings in India are consistent with their reported income.

- Jewellery Definition:

- Includes ornaments made of precious metals or their alloys, with or without precious or semi-precious stones.

- Also includes precious or semi-precious stones set in any utensil, furniture, or apparel.

- Gifted Assets:

- If the asset is acquired by gift, will, or other modes as specified in Section 49(1), the cost should be declared as the cost to the previous owner plus any cost of improvement incurred by the previous owner.

- If the cost is not ascertainable and no wealth tax return was filed, the value can be estimated based on the circle rate or bullion rate at the time of acquisition.

- Disclosure of Liabilities

All liabilities incurred in relation to the disclosed assets must be reported, including Housing loans, Vehicle loans, Personal loans

Reporting in Schedule AL (Assets and Liabilities)

Basic Key points to remember while filling Schedule AL:

- Assets should be disclosed at their cost price. Assets must be disclosed at their cost price. Include any cost of improvement incurred.

- If an asset was part of a wealth tax return (now abolished), the value from that return should be used.

- Any improvements to the asset should be included in its value.

- Non-residents or not ordinarily residents must disclose assets located in India. Non-residents or not ordinarily residents only assets located in India need to be disclosed by NRI and RNOR individuals.

- Liabilities should be disclosed on an actual basis. All liabilities related to the assets should be reported, providing a clear picture of the taxpayer’s financial position in India.

- Challenges with Schedule AL : Assesses may face the following issues while filing Schedule AL:

- Difficulty in determining the cost of assets if records are not available.

- Uncertainty about whether personal assets need to be disclosed.

Conclusion

To ensure high net worth individuals and other entities do not evade taxes, the government introduced Schedule AL (Assets and Liabilities) after the abolition of the wealth tax. This measure was taken to address discrepancies between reported income and actual assets. Schedule AL requires taxpayers with a total income exceeding ₹50 lakhs from any source to disclose all their assets and corresponding liabilities in their ITR. While the increasing disclosure requirements make compliance more demanding, these measures are essential for tackling the issue of black money.

Newly added High-Value Transactions threshold limits

S. No Transaction Type Min. Amount (Rs.) 1 Domestic class Air travel / Foreign travel any 2 Deposit / Credits in non-current Accounts 25 Lakhs 3 Health Insurance premium 20,000 4 Electricity Consumption per year 1 Lakh 5 Share transactions in DMAT Accounts / Bank Lockers any 6 LIC 50,000 7 Purchase of Jewelry, white goods, painting, marble, etc 1 Lakh 8 Payment of educational fee/donations 1 Lakh 9 Payment to Hotels 20,000 10 Deposit / Credits in Current Accounts 50 Lakhs 11 Payment of Property tax per annum 20,000 Additional threshold limits added to enforce the Income-tax

- Deduction/tax collection provision at a higher rate for no tax return filers.

- Compulsory returns for taxpayers Provision

- All professionals with sales above Rs. 50 Lakh

- All whose rental payment exceeds Rs. 40,000 a month

- Which transactions are above Rs. 30 lakh

Here are few tips for avoiding high-value financial transactions with Income tax notices;

- Stay up to date with your PAN details.

- Reveal in your ITR all and correct revenue you have earned during the FY.

- Before the deadline, you must always file your ITR.

- Cross-check your From 26AS for all the TDS entries. This exercise can be repeated once a quarter.

- If any AIR transactions are reported, check your Form 26AS.

- Record all your valuable financial transactions, investments and expenditures