No small business task seems more complicated than payroll , especially since the risk of error can be high. However, you can take proactive steps to reduce the risk of error by performing a payroll audit (or payroll compliance audit). Let’s start with the key reasons to conduct a payroll audit and how to do one.

Conducting an audit can be time-consuming, but as a small business owner, you should do one annually (at least) to uncover errors and ensure you’re meeting these requirements for payroll accounting :

Employment laws can be complex and varied, depending on your location and industry. However, regardless of where your business operates, certain basic laws apply to all employers. These laws help protect employees from discrimination, ensure fair pay and benefits, and prevent workplace harassment.

An audit of your payroll will confirm you’re complying with these key payroll laws:

Payroll audits can protect your business from legal and financial risks but also ensure you pay employees fairly.

If you're a business owner, you understand the importance of paying taxes on time. The IRS and state departments of revenue require businesses to file accurate payroll tax returns and submit taxes withheld from pay.

However, it's not just about ensuring you don't get in trouble with the IRS. You will also have to make tax filings (and deposits) for Social Security, Medicare, and unemployment compensation programs.

If you set up your payroll process correctly, you’ll be able to file returns and make deposits in a timely manner—avoiding fees and penalties.

You want to pay your workers accurately—and they need reliable payroll information to file a personal tax return. You’ll need to confirm that the pay rate, vacation days, and paid time off benefits are accurate.

When you issue 1099s and W-2s , they must be correct. If not, you’ll have tax issues for workers who rely on your tax forms. An audit can also help find people on your payroll who your company no longer employs.

You may also uncover a fictitious payee, or ghost employee, who does not exist. This fraud happens when an employee adds a fake worker to the payroll records to collect the payments for themselves.

Payroll audits confirm the accuracy of the payroll records. Conduct the audit by comparing these records:

Employees can request a payroll audit of their data if they believe that an error took place. Encourage your workers to contact you if they are uncertain about their payroll information.

Larger businesses often have a compliance officer responsible for payroll compliance.

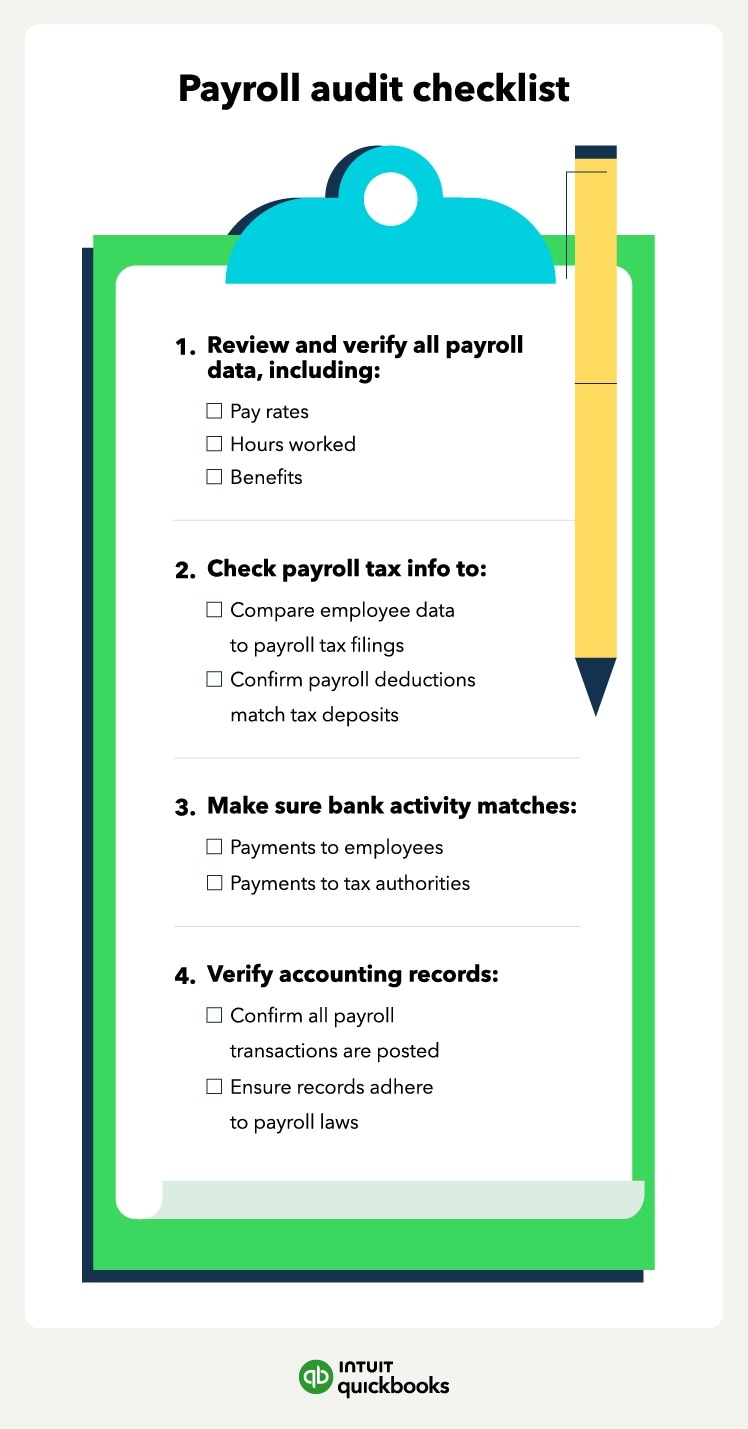

The first step in a payroll audit is to review employee payroll data. Here’s the key payroll data you’ll want to look at:

Reviewing payroll data is essential for identifying discrepancies, fraud, and errors while ensuring compliance with legal requirements and improving overall payroll processes.

Next is verifying that all tax forms and deposits are accurate and up to date. This step is essential for complying with tax laws and avoiding penalties or fines.

In particular, check your Form 941, which reports federal income tax withholdings to the IRS, for:

Also, ensure you make all your tax deposits with the appropriate authorities within the designated time frame, such as Social Security and Medicare taxes.

To conduct a thorough payroll audit, take a close look at your bank statements. By examining the bank activity, you can verify that your payments to employees were timely and accurate.

Even if you outsource payroll, it's important to match employee payment records. Mistakes by payroll service providers happen, which can end up resulting in fines for the company.

The final step is to confirm that you record all payroll expenses properly in the company's accounting software and that the data matches bank statements.

Ensure all payments to employees are accurate and that there are no discrepancies between what is in the company's books and payments.

Even if you outsource your payroll processing, you'll want to ensure all payments and tax filings are accurate and timely.

Conducting a payroll audit can help uncover errors and identify opportunities for improvement in the payroll process. Here's what to expect when starting a payroll audit process:

It depends on various factors, such as the size of the business, the complexity of the payroll process, and the risk of payroll fraud or errors. But here’s a general guide:

Conducting payroll audits on a more regular basis can help identify any errors or discrepancies so you can quickly address them. It can also help prevent payroll fraud and ensure that all employees get accurate pay.

Employers should also base the frequency of payroll audits on any concerns or issues that arise within the payroll process.

If there are concerns of fraud or errors, for example, conducting an immediate audit is necessary to minimize any potential financial losses and ensure accurate financial reporting.

For small businesses with a straightforward payroll process, a payroll audit can typically be completed in a few days. This simple audit typically involves reviewing payroll records, bank statements, and other financial documents to ensure compliance with employment laws and identify any errors or discrepancies.

In some cases, an external audit may be necessary, adding additional time and expense to the audit process.

For larger businesses with more complex payroll processes and more employees, the payroll audit process can take several weeks. These audits may require a more comprehensive review of payroll records, which can include reviewing payroll registers, employee time cards, tax withholdings, and overtime hours.

An IRS payroll audit is an examination conducted by the IRS to determine the accuracy of an organization's payroll process, tax withholdings, and compliance with employment tax laws. During the audit, the IRS may review payroll records, employment tax returns, W-2 and 1099 forms , and other relevant financial documents.

If a company fails a payroll audit, it can have serious consequences and result in financial losses for the company. The company may have to pay penalties, fines, back taxes, and interest . Additionally, failing a payroll audit can damage the company's reputation and result in a lack of trust from employees and stakeholders.

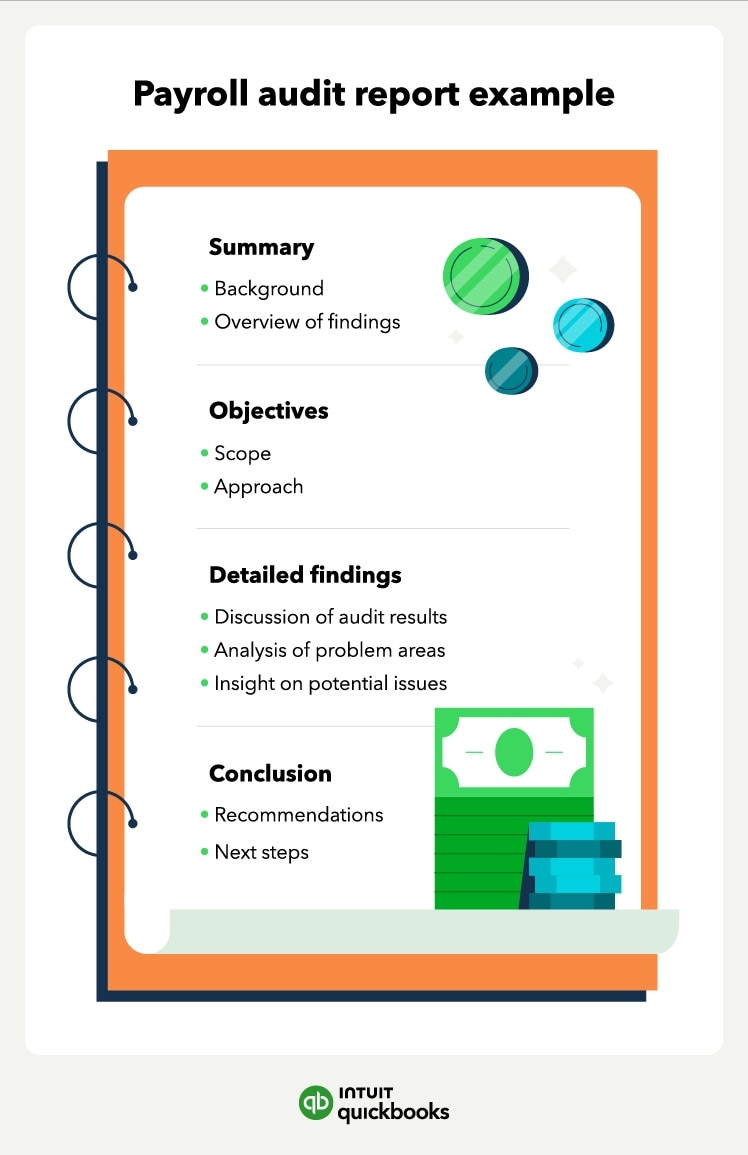

A payroll audit report is a comprehensive document that outlines the findings of a payroll audit. This report is essential for businesses as it provides insight into their payroll processes, identifies errors or issues, and recommends improvements to ensure compliance with employment laws.

An example of a payroll audit report may include a summary of the audit findings, an assessment of the accuracy and completeness of payroll records, and a review of employee pay rates and related tax withholdings. The report may also include a review of the company's payroll policies and procedures to identify areas that require improvement.

Additionally, the payroll audit report will include recommendations, like implementing new procedures, improving payroll employee training, or upgrading the company's payroll software.

You’ll get the most benefit out of conducting annual payroll audits by using best practices. These tips will help you conduct a payroll audit accurately and quickly:

As a business owner, it's critical to understand the basics of a payroll audit and how to conduct it—these best practices will ensure a smooth process.

A payroll audit report should provide specific and actionable recommendations to the company's management team.

A payroll audit is much easier if you leverage technology. Payroll auditing requires a business to audit hundreds (or thousands) of transactions. Use a payroll service or software to process payroll in less time and to minimize the manual work required to perform a payroll audit.

Recommended for you

Automate payroll: A guide to payroll automation

Payroll for remote employees: A tax guide

How to track employee time: 8 methods to try

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.